The United States Bureau of Economic Analysis (“BEA”) conducts the BE-12 Benchmark Survey every five years to collect critical data to produce statistics on the state of foreign investments in the United States.

The BE-12 Benchmark Survey is required for certain U.S. companies in which foreign persons or entities hold voting ownership interest (or the equivalent) of ten percent (10%) or more. The BE-12 report is required at the end of the business enterprise’s fiscal year that ended in calendar year 2022.

Mandatory Survey

Reporting on the BEA’s direct investment surveys is mandatory under the International Investment and Trade in Services Survey Act.

Reporting Deadline

A completed BE-12 report covering the entity’s fiscal year ending in calendar year 2022 is due no later than June 30th, 2023. An extension to July 30th may be requested if filing electronically.

Penalties

Failure to report may result in civil penalties, fines, imprisonment, or other legal actions. This applies to individuals, corporations, and their officers, directors, employees, or agents who knowingly participate in the violation. It is crucial to comply with the reporting requirements within the deadline to avoid these potential consequences.

Data Confidentiality

The act protects the confidentiality of the data that entities report. The act specifies that the survey data may only be used for statistical and analytical purposes. The BEA is prohibited from granting another agency access to the data for tax, investigative, or regulatory purposes. In addition, data reported on the BEA’s surveys are not subject to Freedom of Information Act (FOIA) requests.

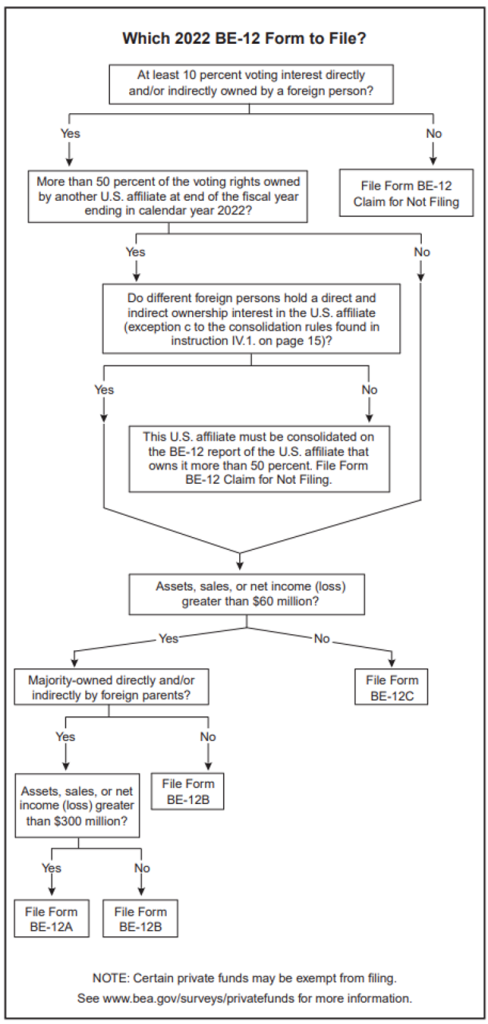

Which 2022 BE-12 Form To File?

Form BE-12A

File for reporting U.S. affiliates that are majority-owned by foreign parents at the end of the fiscal year that ended in calendar year 2022 if any one of the following three items—total assets, sales or gross operating revenues excluding sales taxes, or net income (loss) after provision for U.S., State, and local income taxes—exceeded $300 million at the end of, or for, the fiscal year that ended in calendar year 2022. A majority-owned U.S. affiliate is one in which the combined direct and indirect ownership interests of all foreign parents of the U.S. affiliate exceed 50 percent.

Form BE-12B

File for reporting U.S. affiliates that are majority-owned by foreign parents at the end of the fiscal year that ended in calendar year 2022 if any one of the following three items—total assets, sales or gross operating revenues excluding sales taxes, or net income (loss) after provision for U.S., State, and local income taxes—exceeded $60 million but none of those items exceeded $300 million at the end of, or for, the fiscal year that ended in calendar year 2022. A majority-owned U.S. affiliate is one in which the combined direct and indirect ownership interests of all foreign parents of the U.S. affiliate exceed 50 percent.

File for reporting U.S. affiliates that are minority-owned by foreign parents at the end of the fiscal year that ended in calendar year 2022 if any one of the following three items—total assets, sales or gross operating revenues excluding sales taxes, or net income (loss) after provision for U.S., State, and local income taxes—exceeded $60 million at the end of, or for, the fiscal year that ended in calendar year 2022. A minority-owned U.S. affiliate is one in which the combined direct and indirect ownership interests of all foreign parents of the U.S. affiliate are at least 10 percent but do not exceed 50 percent.

Form BE-12C

File for reporting U.S. affiliates owned by foreign parents at the end of the fiscal year that ended in calendar year 2022 if none of the following three items—total assets, sales or gross operating revenues excluding sales taxes, or net income (loss) after provision for U.S., State, and local income taxes—exceeded $60 million at the end of, or for, the fiscal year that ended in calendar year 2022. A foreign-owned U.S. affiliate is one in which the combined direct and indirect ownership interests of at least one foreign parent of the U.S. affiliate are at least 10 percent.

Form BE-12 Claim for Not Filing

File for: (1) a U.S. affiliate that is consolidated into or merged with another U.S. affiliate, OR (2) an entity that is not directly or indirectly foreign-owned. Also use this form type if the U.S. affiliate’s foreign ownership fell below 10% or if it was liquidated or dissolved before the end of the fiscal year.

For more information regarding BE-12 reporting requirements please visit www.bea.gov/surveys/be12