Belize economic substance | The economic substance Act, 2019 (ES Act) in Belize was enacted on October 12, 2019, and came into force on January 1, 2019.

This act applies to legal entities which are incorporated or continued under the International Business Companies Act (Chapter 270) – i.e. IBCs.

This legislation was introduced to address the concerns expressed by the Council of the European Union (EU) with respect to the absence of economic substance requirements for companies doing business in and through Belize. The enactment of this legislation reinforces Belize’s commitment to meeting the international requirements on tax transparency.

Applicability and provisions | Belize economic substance

An “included entity” is an IBC that is engaged in one or more of the following Relevant Activities outlined in the ES Act:

*as a holding company, engaged, or where one or more of its subsidiaries is engaged in one of the activities listed above.

A “non-included entity” is an IBC that does not conduct relevant activities in Belize or an IBC that is tax resident in a jurisdiction other than Belize, that is not included in the EU list of non-cooperative jurisdictions.

The Belize Economic Substance requirements of the ES Act shall only apply to include entities that are tax residents in Belize.

Where an IBC claims to be a tax resident outside of Belize, it must provide evidence of its tax residence with a letter or certificate issued by the competent tax authority of said jurisdiction.

In the absence of such evidence, the entity will be regarded as an included entity that is subject to the substance requirements of the Act.

The International Financial Services Commission will exchange all information received from an entity claiming foreign tax residence with the relevant jurisdiction(s) in accordance with articles 4 and 7 of the OECD Convention on Mutual Administrative Assistance in Tax Matters.

Reporting obligations | Belize economic substance

All IBCs must report their status in the Economic Substance regimen on an annual basis through their Registered Agent to the Competent Authority, the Belize International Financial Services Commission (“IFSC”).

To comply with Economic Substance reporting, all IBCs must first obtain a Tax Identification Number (“TIN”) from the Registry. Having a TIN number does not mean that the IBC is liable for tax in Belize. The purpose of this initiative is strictly for regulatory and tax authorities to efficiently monitor the status of the IBC.

Thereafter, IBCs must complete the appropriate form to be signed either by a Director or by a majority Shareholder.

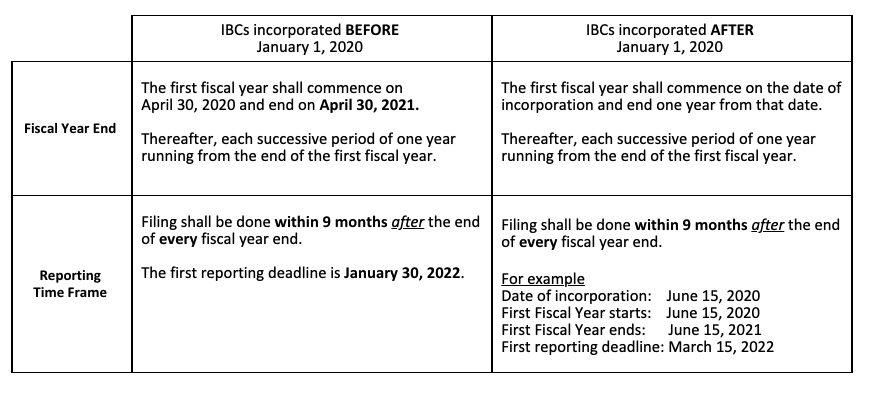

The time frame for reporting adherence to the ES Act is determined by the fiscal year-end of an IBC as follows:

Substantial economic presence

An “included entity” demonstrates substantial economic presence in Belize if the following criteria relating to Board management and control are satisfied,

- An adequate number of meetings of the Board of Directors are conducted in Belize given the level of decision-making required;

- There is a quorum of the Board of Directors present for meetings in Belize;

- Strategic decisions of the included entity made at the meetings specified in paragraph (a) must be recorded in the minutes of the meetings;

- All records and minutes of the included entity are kept in Belize; and

- The Board of Directors has the necessary knowledge and expertise to discharge its duties.

It is the primary responsibility of the included entity to demonstrate that it conducts core income-generating activities (“CIGAs”) in Belize proportionate to its business activities. This shall include adequate:

- amounts of annual operating expenditure;

- number of qualified full-time employees; and

- physical offices.

Reduced substance requirements for Pure Equity Holding Companies (PEHC)

An “included entity” that engages in business as a pure equity holding company is subject to reduced substance requirements, as follows

- It shall comply with all applicable laws and regulations of Belize; and

- It shall have adequate human resources and premises in Belize for holding equity participation in other entities and where it manages those equity participations in other entities, have adequate human resources and premises in Belize for carrying out the management.

Outsourcing | Belize economic substance

An “included entity” may satisfy its Belize Economic Substance requirements by outsourcing its CIGAs in relation to that relevant activity to persons in Belize licensed by the IFSC as a Managing Agent. The included entity must monitor and control the execution of the CIGAs performed by the Managing Agent. The outsourced CIGAs must take place in Belize, and the supervision of the outsourced activities by the outsourcing entity must also take place in Belize.

Sanctions

Sections 18 and 19 of the ES Act state penalties for non-compliance in:

- meeting substance requirements,

- failing to file the report on substance requirements, and/or

- failure to comply with any directive issued by the Competent Authority regarding any remedial actions the entity must take to comply with the ES Act.

Entities that incur any of these violations under the ES Act may be subject to enforcement actions, which may consist of:

- a suspension or revocation of license (if it is an entity licensed for regulated activities under the International Financial Services Commission);

- administrative penalties;

- strike off from the Register of International Business Companies

The administrative penalties may range from BZD 150,000 to BZD 300,000 or imprisonment for a term of one year or both. If the Competent Authority finds that the violation persists, a further administrative penalty of BZD 1,000 may be applied for every day the violation continues.

The ES Act does not exempt struck-off companies from complying with the annual economic substance reporting and adequate substance as applicable.

For more information and guidance on the ES Act, please review the following resources at the Belize International Financial Services Commission.

Belize International Financial Services Commission – Economic Substance Flow Chart

Belize Economic Substance Act, 2019

Belize Economic Substance Act, 2019 – GUIDANCE NOTES

If you are interested in reading more about OMC Group access our blog.